Welcome to our Q2 Luxury Travel Index Report, Luxury Travel Advisor’s deep dive into the latest trends for the global luxury travel industry.

Welcome News From the Front Lines

The good news is that travel advisors are still extremely optimistic about the future of the luxury travel industry, with an optimism rating of 8.6 (out of a possible 10).

The largest segment of respondents (29 percent) indicated personal gross sales of $1 million to $1.9 million in 2023. Slightly less indicated between $500,000 and $999,999 (17 percent) or less than $500,000 (24 percent).

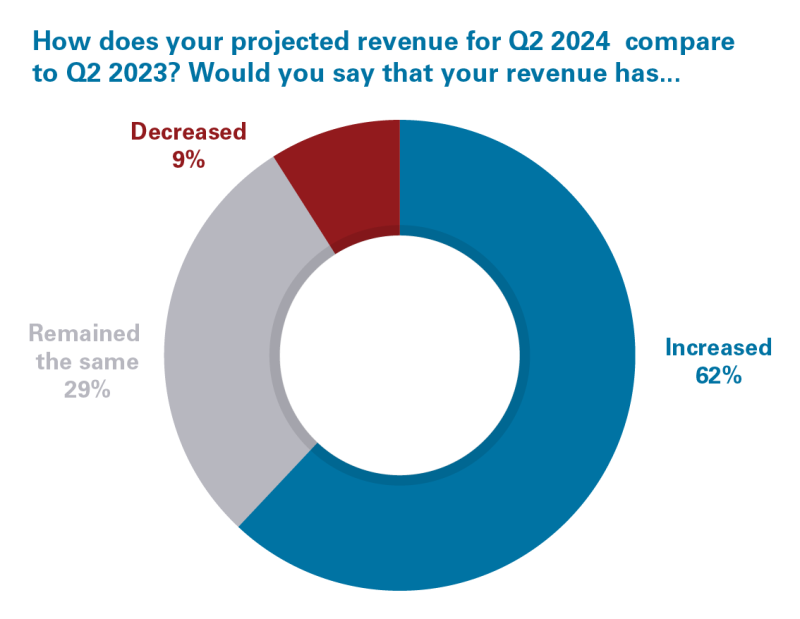

Revenue was projected to increase for most when comparing Q2-2024 to Q2-2023.

More than six in 10 respondents (62 percent) projected their Q2-2024 revenue was going to be higher than Q2-2023, a very good year for the industry. Another three in 10 (29 percent) indicated that revenue would remain the same.

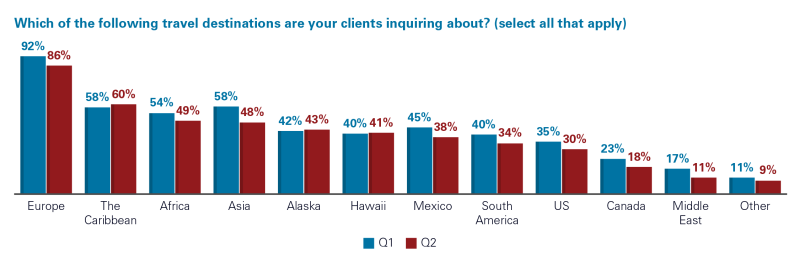

Europe Still Leading the Way

Nearly nine in 10 respondents (86 percent) indicated that their clients are inquiring about travel to Europe. Another six in 10 (60 percent) indicated the Caribbean. Nearly half indicated Africa (49 percent) and/or Asia (48 percent).

Booking Window

The largest segment of respondents (37 percent) indicated that their clients typically book their travel between six and nine months before their travel date. Another three in 10 (30 percent) indicated 10 months or more. This question was not asked in our Q1 survey, but we’ll continue to index this behavior in future studies. Our view on these statistics is that because clients are booking a healthy amount of time out for their luxury trips, their advisors are doing a good job of educating them that they need to book far out to secure the best suites, cruise ship penthouses and seats in the front of the plane. Just a small percentage (5 percent) are booking less than three months out; we’ll continue to gauge that but we do believe a small sector of travelers will always book close in, depending on their schedule or simply on an impulse to get away.

The takeaway here is that marketers need to get in front of the luxury travel advisor—and their clients—well ahead of time if they want to influence the decision-making process for major trips.

Travel Advisors As Influencers

Our data also shows that the luxury travel advisor has tremendous influence over their clients’ decisions; in fact, more than seven in 10 (71 percent) indicated their clients were very likely to take their advice. Another three in 10 (27 percent) indicated four out of a possible five-point likelihood scale. Those numbers are completely in synch with Q1 responses.

Travel Frequency is Increasing

More than half of the respondents (53 percent) indicated that their clients were traveling more often. Another four in 10 (41 percent) indicated the same. This indicates that affluent consumers are increasingly making travel a priority.

Spend Per Trip Maintained

The typical client spends between $10,000 and $24,999 on a luxury vacation.

To that point, the largest segment of respondents (46 percent) indicated their average client spend per vacation was between $10,000 and $24,999. One in four (25 percent) indicated between $25,000 and $49,999. These figures are on par with Q1.

Where the Money Is Going

The survey shows that clients were most likely to splurge on hotels and excursions/experiences.

Three in four respondents (75 percent) indicated that their clients were most likely to splurge on hotels; that figure inched up by five points over Q1. Two in three (64 percent) indicated excursions/experiences, just about on par with Q1.

Generational Spend: New Trend or Blip?

The consensus is that Baby Boomers spend the most on luxury travel.

More than half of the respondents (55 percent) indicated that Baby Boomers spend the most on luxury travel. The next closest was Gen X at one in three (33 percent).

We saw less spending by Baby Boomers in Q2 than in Q1 and more spending by Gen X. Will this trend continue or is it a temporary blip? Are Baby Boomers, as they get older, spending less or traveling less?

Sources for Travel Advice

Friends and family was the most mentioned client source for luxury travel information.

Eight in 10 respondents (79 percent) indicated that their clients turn to friends and family for information about luxury travel. Travel websites (56 percent) was the next most mentioned. Printed matter (38 percent), Instagram (37 percent) and Facebook (35 percent) were all mentioned by more than one in three.

One to Watch: We saw a 10 point increase in the use of YouTube (13 percent in Q1 and 23 percent in Q2) being an influential resource and a three point increase from TikTok.

Use of AI on Upswing

Our study showed that travel advisors are increasingly using artificial intelligence in their work.

More than four in 10 respondents (42 percent) indicated they were not using AI in their business at all, but that’s an increase from our Q1 survey when 57 percent said they weren’t using it. Twenty-three percent said they are using it “a moderate amount,” and that’s an increase from 15 percent in Q1.

Those who commented on how they are using AI provided the following:

- “I use ChatGPT for quick references, sometimes for itinerary highlights and to rewrite vendors explanations.”

- “I use it to plan activities in a city and to determine the pacing for a trip.”

- “I use it for researching destinations and quickly pulling together itineraries that can be fleshed out. Also for location stats and demographics.”

- “An example of how I use AI in my business is to create flyers and email campaigns for my current and potential clients.”

- “I use it for automated billing construction.”

- “We use it for emails to clients.”

- “I use it to create blog content & Facebook posts.”

- “It writes my letters to my clients and also writes my post on social media.”

- “We use it for populating Travefy, writing web copy and social media posts.”

- “Our agency uses it for monitoring quality assurance.”

- “We use it for summaries to generate lists of travel sites, itineraries, recommendations and packing lists.”

- “I use it to correct grammar.”

Download the full Q2 Luxury Travel Index Report now!

The online survey methodology was used for this research project. Luxury Travel Advisor provided the sample for this study. The first wave of survey invitations were sent on July 8th. Three more invitations were sent over the next four weeks. The survey remained open until August 26th. During that time, 160 luxury travel industry professionals completed the survey. The largest segment of respondents to our survey said their job title was “travel advisor – independent contractor” (48 percent). Nearly three in 10 (29 percent) identified as travel agency owner/president.

Related Articles

Questex's LTA Launches New Quarterly Luxury Travel Index

Show This to Your Clients: Column